One of my friends was recently commissioned to write the catalogue for a contemporary art exhibition. In solidarity, I attended the gallery walk-through on the day of the inauguration. I understood very little of what was on display, and I suspect that most in the room were equally flummoxed by the pieces. But what I did notice was the fact that a billionaire-family’s Foundation supported the artists, a highly informed and articulate gallery owner passionately ‘explained’ the pieces and the crowd in attendance was ‘elite’.

I returned home curious and wanted to understand the economics of the art market. Since my social network is nothing much to speak about, I relied on the only other available option- picking up a book.

Don Thompson’s ‘The 12 Million Stuffed Shark’ was an entertaining read and it packed in so much information on the contemporary art market that was hitherto unknown to me.

In a nutshell, most of the contemporary art has no intrinsic value in itself. The market value of an art piece and the brand of the artist is dependent on only one factor – anointment by the gatekeepers of the industry. The global market is run by a few hotshot galleries run by celebrity dealers, auction houses (secondary art market) and a bit by museum curators and a few art critics. High prices are driven by this cabal with the buyers having little influence. In the auction market, Christie’s and Sotheby’s share 80 per cent of the world market in high-value art, and an almost absolute monopoly on works selling for over $1 million.

A sought-after artist is one who has already passed several gatekeepers. The artist has been accepted and shown by a mainstream dealer, and usually moved to representation by a superstar dealer. The artist’s work has been cleverly marketed, placed in branded collections and with branded art museums. The work has appeared in evening auctions at Christie’s or Sotheby’s. It is this process, not aesthetic judgement and certainly not critical acclaim, that defines the hot artist.

The contemporary art market is thriving due to the simple fact that all the other schools of art have more or less disappeared from the market. This in turn has been driven by the worldwide expansion of museums and the rise of the private collector. Every city seeks immortality and a place on the art circuit by boasting of the exclusive collections in their museums. The past twenty-five years have seen a hundred new museums around the world, each intent on acquiring, on average, 2,000 works of art.

In the Middle East alone, four new museums – the Louvre and Guggenheim in Abu Dhabi, one in Dubai and one in Sharjah plus a new contemporary museum in Qatar, will between them absorb 400 to 500 works each year for the next ten to fifteen years. Imagine! Each museum will focus on branded artists, with the result that auction houses and dealers are flocking to open new offices in the Emirates. The Lawh Wa Qalam: M. F Husain Museum which opened up in Doha last week should be seen in this backdrop. The museum opening was extensively covered in the Indian media. (While the museums springing up in the Middle East is great news, spare a thought for the geopolitics, the economic diversification at play, the gentrification of the cities and the other debates around culture, political systems and norms.)

For an artist, breaking into this world is not a simple task. In the words of Thompson:

There are approximately 40,000 artists resident in London, and about the same number in New York. Of the total of 80,000, seventy-five are superstar artists with a seven-figure income. Below those are 300 mature, successful artists, who show with major galleries and earn a six-figure income from art. On the next level down are about 5,000 artists who have some representation, most in a mainstream gallery, and who supplement their income through teaching, writing, or supportive partners. There are thought to be 15,000 artists walking the streets of London at any one time looking for gallery representation, and the same number in New York. This number actually increases each year as publicity given to the high prices paid for contemporary art attracts more young artists to the profession,

Each top gallery owner too spends an inordinate amount of time each year visiting the four major art fairs – Basel, Maastricht, Miami and London and marketing their artists with clever ploys. (This in turn gives rise to the world of consultants and critics).

Charles Saatchi is today considered to be the most influential and powerful art dealers in the contemporary art market. In the early 90s, British artist Damien Hirst stuffed a shark in a tank filled with formaldehyde. When Saatchi picked it up, the exhibit eventually ended up being sold for $12 million! Saatchi’s other claim to fame was that he was also married to the celebrity chef and BBC cookery presenter Nigella Lawson!

And finally, all of this is also possible due to the simple fact that the number of millionaires and billionaires have gone up over the last 25 years. So the demand for million dollar pieces to decorate offices, living rooms and bedrooms has understandably hit the roof.

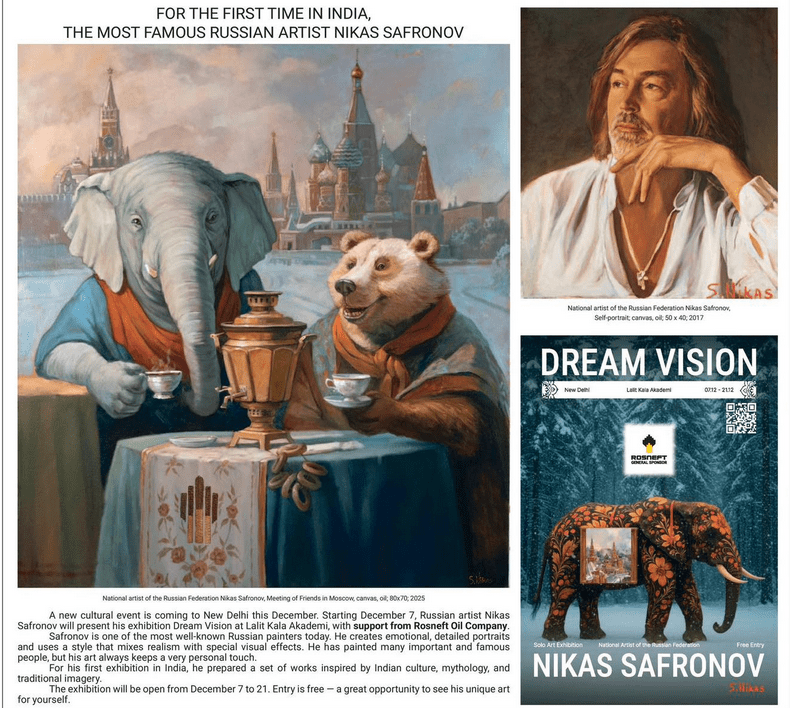

P.S: Last week, this advertisement was splashed across the Indian Express. It has all the elements of the mix- a ‘hotshot’ artist, a gallery marketing his wares, corporate sponsorship, an international tour.

If I visit the Kochi Biennale this time, I now will have a better mental model to ‘see’ the stuff displayed there!

Discover more from Manish Mohandas

Subscribe to get the latest posts sent to your email.

One thought on “The Contemporary Art Market”