When something sounds too good to be true, always be suspicious. The incoming revolution in the transport sector heralded by Musk revolutionizing EVs – by making them an object of desire – has been touted as the best thing to have happened to mankind. While the energy to power these vehicles will someday be ‘clean’, the same can’t be said for its most critical component – the battery.

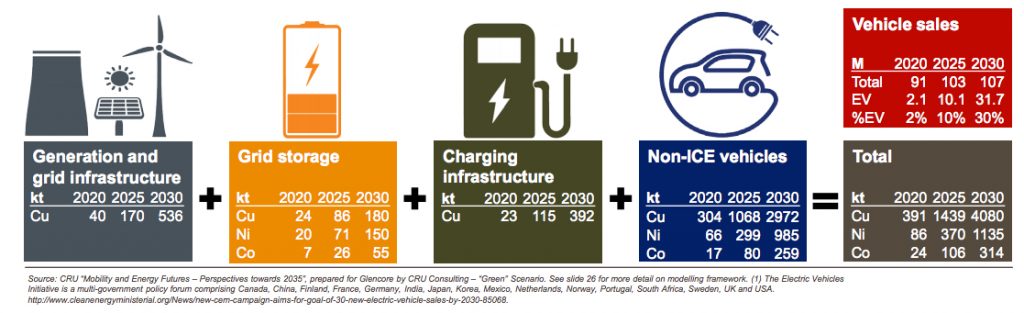

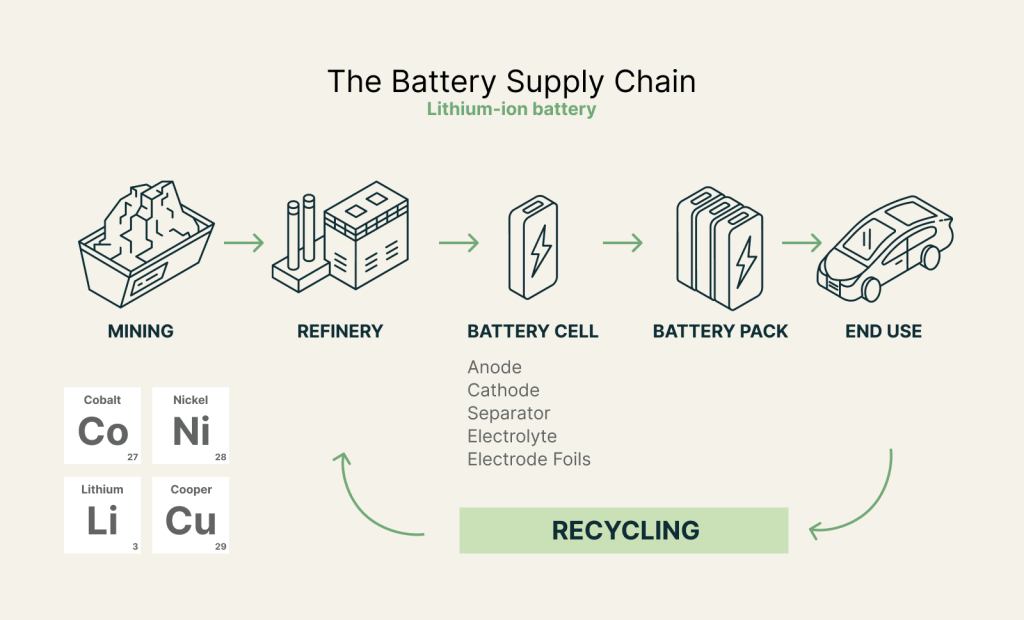

Every electric battery needs loads of Lithium, Cobalt, Copper and Nickel. And trying to trace out the supply chains of these minerals is one place to start to appreciate how complex, murky and violent the whole field is. Henry Sanderson’s Volt Rush was a good primer on this.

Lithium:

Almost every electronic device we handle runs on Lithium. The International Energy Agency estimates that demand for lithium is set to grow thirty-fold by 2030 and more than a hundred times by 2050. Half of the world’s Lithium is mined in Australia and almost the whole of it is gobbled up by China. The geopolitical tensions have now spurred Australia to ramp up its own processing capabilities. (The other significant Australian import for the Chinese is iron ore. It wouldn’t be wrong to state that the Chinese economic miracle has been built with Australian iron ore)

Despite mining just a fraction of the worlds Lithium, China processes over eighty percent of the global lithium mined. Irrespective of where the Lithium is mined, a substantial chunk of it ends up passing through China. And the company at the center of this is a little known enterprise called CATL – one of the largest listed companies in China. An excerpt about CATL’s tentacles can be read here:

Cobalt:

Over 60% of the world’s cobalt comes from the Congo. The Congo of Leopold II, Mobutu Seko, Laurent Kabila and Joseph Kabila. The Swiss based Glencore group is one of the world’s largest Cobalt miner and is one of Tesla’s leading Cobalt procurement partners. Their foray into Congo’s murky world of mining was facilitated by the Israeli diamond businessman Dan Gertler who ended up on a US sanctions list. (A full explanation of their shenanigans will warrant a separate blog post). But if you’re curious, some information can be found here.

A lot of the mining in Congo is also done by individuals categorized as artisanal miners. Cobalt Red, published earlier this year is another book that documents this entire world. NPR’s review of it can be a good place for some more background.

Congo is a classic case of a country facing a Resource curse. The boom in the global automobile industry in the 18th century, led to a surging demand for rubber. Leopold II’s Congo had quotas for rubber collection and the price for not meeting them was having one’s hands chopped off. (Some more context around this and Antwerp’s chopped-hands chocolates can be read from this excellent post by Karma Colonialism). The casings for the ammunition used in WWI primarily came in from the Congo and so did the Uranium that went into making the bombs that were dropped in Hiroshima and Nagasaki.

Copper:

Sanderson estimates that replacing one-third of the existing automobile fleet with EVs would alone take up the entire existing global consumption of copper. And if you’re wondering which country has the largest reserves of copper, look no further. It’s Congo!

Nickel

Stainless Steel is made from Chromium and Nickel. Without these two metals, none of our kitchen appliances would exist. While stainless steel never had the clout to emerge as something of geopolitical importance, EVs do. The largest Nickel reserves in the world lie in Indonesia. But mining nickel from the laterite deposits of Indonesia is energy intensive and mostly powered by coal. And even more troubling is the risk of contamination. A Chinese owned mine in the PNG spilled 200,000 litres of slurry into the seas and faced the music.

Despite all the gloom and doom, a transition away from fossil fuels is underway and the future is going to be electric. While fossil fuels have provided immense benefits to human societies, their era seems to be up. The EV revolution is here to stay and the future of our mobility is electric. What we need is a revolution in the circular economy which incentivizes the reuse of these critical elements. The advantage of metals is that, almost all of it can be recovered and reused. We’ve done that reasonably well with aluminium, copper and steel; so doing the same with the rest is just a matter of time. (Related post: Thinking About Waste)

Enterprises such as Sweden’s Northvolt have already embarked on trying to meet Europe’s demand for green transportation by greener ways. Just as the Ukrainian war accelerated Europe’s green transition, the price mechanism should soon kick in and bring some stability to the EV space. But I’m already betting that if the wars of the 20th century were fought for oil, the wars of the near future will be over metals and chips.

Discover more from Manish Mohandas

Subscribe to get the latest posts sent to your email.

And many more wars will be fought in the Cyber realm..

LikeLike